Self-insurance for healthcare is a growing trend that involves individuals taking on the financial responsibility of their healthcare costs rather than relying on traditional private health insurance. This works by an employer providing an employee with a predetermined amount of money to put towards their healthcare expenses each year (or other period), which would otherwise go towards paying limiting, conditional and non-personalised private health insurance plans.

With funds available in a dedicated health-only account, you as an employee then have the flexibility to choose how to spend that money in the way that works best for you and your family, whether that’s for medical care or other health-related products, supplements or expenses.

With many taking 2023 to re-evaluate their expenses given rising inflation and interest rates with no plateau in sight, asking employers to switch their health allocations into a self-insurance account is rapidly growing in popularity for many important reasons including cost savings, greater control over healthcare decisions, and the ability to tailor coverage to individual and family needs.

Cost-Saving Benefits To Employees

One of the most significant benefits of self-insurance for healthcare is the cost savings, which is attained in several ways. Most generic private health insurance plans covered by employers have very strict stipulations and limitations on what is and isn’t covered. This includes a minimum of one year (to three years) stand down periods for popular services, during which time the employee will be completely out of pocket for that expense with no employer contributions, despite many of the services being necessary in order to recover well and for the long-term by treating the cause of an issue, and not just the symptoms.

One of the most significant benefits of self-insurance for healthcare is the cost savings, which is attained in several ways. Most generic private health insurance plans covered by employers have very strict stipulations and limitations on what is and isn’t covered. This includes a minimum of one year (to three years) stand down periods for popular services, during which time the employee will be completely out of pocket for that expense with no employer contributions, despite many of the services being necessary in order to recover well and for the long-term by treating the cause of an issue, and not just the symptoms.

Another cost saving is avoiding the common copayment that employees must pay to subsidise their private health insurance – regardless of how much or little value they’re receiving out of it. This value often sits at around $30 per month, or $360 per year. On the claims you are eligible to make, private health insurers only pay a percentage of the cost – often around 75% to 80%. This means that you’re still left out of pocket for each claim, even if you’ve only made one or two claims that calendar year.

Finally, private health insurance also battles with the perception of “losing money” when few claims are made in a calendar year that justifies the cost of the insurance (for both the employee and employer), making the expense feel like “wasted money”. As a result, many clinics in countries like Australia run a “use it or lose it” campaign to encourage those about to ‘lose’ their unclaimed benefits for the year to engage in last-minute services that they may or may not need. While this may be seen as an added bonus, it doesn’t address the real issue of having funds that can go towards the health services and products that they really do need and will benefit their long-term health and well-being, without limitations. Better yet, none of the funds from self-insurance with companies like HealthNow are ‘lost’ at the end of the financial or calendar year – instead they roll over so if unused, you’ll have even more funds available to use in the following year.

Greater Control Over Healthcare Decisions

Another advantage of self-insurance for healthcare is that it gives employees much greater control over their healthcare decisions. Rather than being limited to specific services, which hold many exclusions based on pre-existing conditions (meaning the services you often need to access the most are excluded) and that are often kept primarily at a ‘specialist’ level only due to the ‘standard’ nature of bulk private health insurance plans, having funds for self-insurance means that you have no limitations on the type of healthcare that is best for you, within a large national network of health providers across a very broad range of services – from skin checks to eye and hearing testing to nutritionist and pharmacy prescriptions.

Having this great control over how to best take care of your health means greater healthcare outcomes – because you’re able to act proactively to better your health, instead of being able to see a specialist when your health has notably deteriorated. It is well documented that the prevailing Western model of healthcare has long been ‘reactive’ as opposed to ‘proactive’ – and while this may work for some short-term, acute illnesses, it largely fails when it comes to chronic conditions like cardiovascular disease and diabetes, which typically worsen gradually over time. By the time there are enough symptoms to trigger a trip to the doctor, irreversible changes may have already occurred.

Given that a large number of musculoskeletal injuries are also ‘overuse’ in nature, meaning they’re not caused by a one-off event (like trauma) but develop gradually over time, traditional private health insurance does not leave room for a person to receive funding to establish healthy baselines to best support them throughout their lives, instead only working to treat injuries once they have occurred without getting down to their underlying causes. This can be particularly important when it comes to services like nutrition and dietetics, where the benefits of good nutrition has repeatedly shown with strong clinical evidence in improving clinical outcomes in a variety of circumstances, from illness recovery to preventing further complications of medical conditions.

Tailored Coverage For People And Families

Self-insurance for healthcare also has great value in being able to consider what is truly best for a person and their families in their current life circumstances. In healthcare and medical training, practitioners are extensively taught on the value of looking at a person as a ‘whole’, in their complex medical and personal nature, in order to deliver the best, most appropriate and timely care that they are likely to respond well to. Yet standard private health insurance set out in an employer schedule do just the opposite – treat everyone like they have the same health needs in any calendar year, making very firm assumptions on what should be included and excluded, and prioritising ‘reactive’ specialist treatments.

Self-insurance for healthcare also has great value in being able to consider what is truly best for a person and their families in their current life circumstances. In healthcare and medical training, practitioners are extensively taught on the value of looking at a person as a ‘whole’, in their complex medical and personal nature, in order to deliver the best, most appropriate and timely care that they are likely to respond well to. Yet standard private health insurance set out in an employer schedule do just the opposite – treat everyone like they have the same health needs in any calendar year, making very firm assumptions on what should be included and excluded, and prioritising ‘reactive’ specialist treatments.

This is where self-insurance has great superiority – allowing a person to recognise and support the stage of life that they’re at – whether as a single young employee that has just joined the workforce and perhaps spends more time working out and therefore will benefit most from musculoskeletal care (much of which is excluded from standard private plans, both proactively and reactively unless it’s very serious), or as an older employee with a family who may benefit most from their families having greater financial support, given the strong connection between the health of of both adults and children within a family, and the individuals own health, particularly when factors like stress and missed days off work caring for unwell family members are considered.

When Self-Insurance Is The Best Option For You

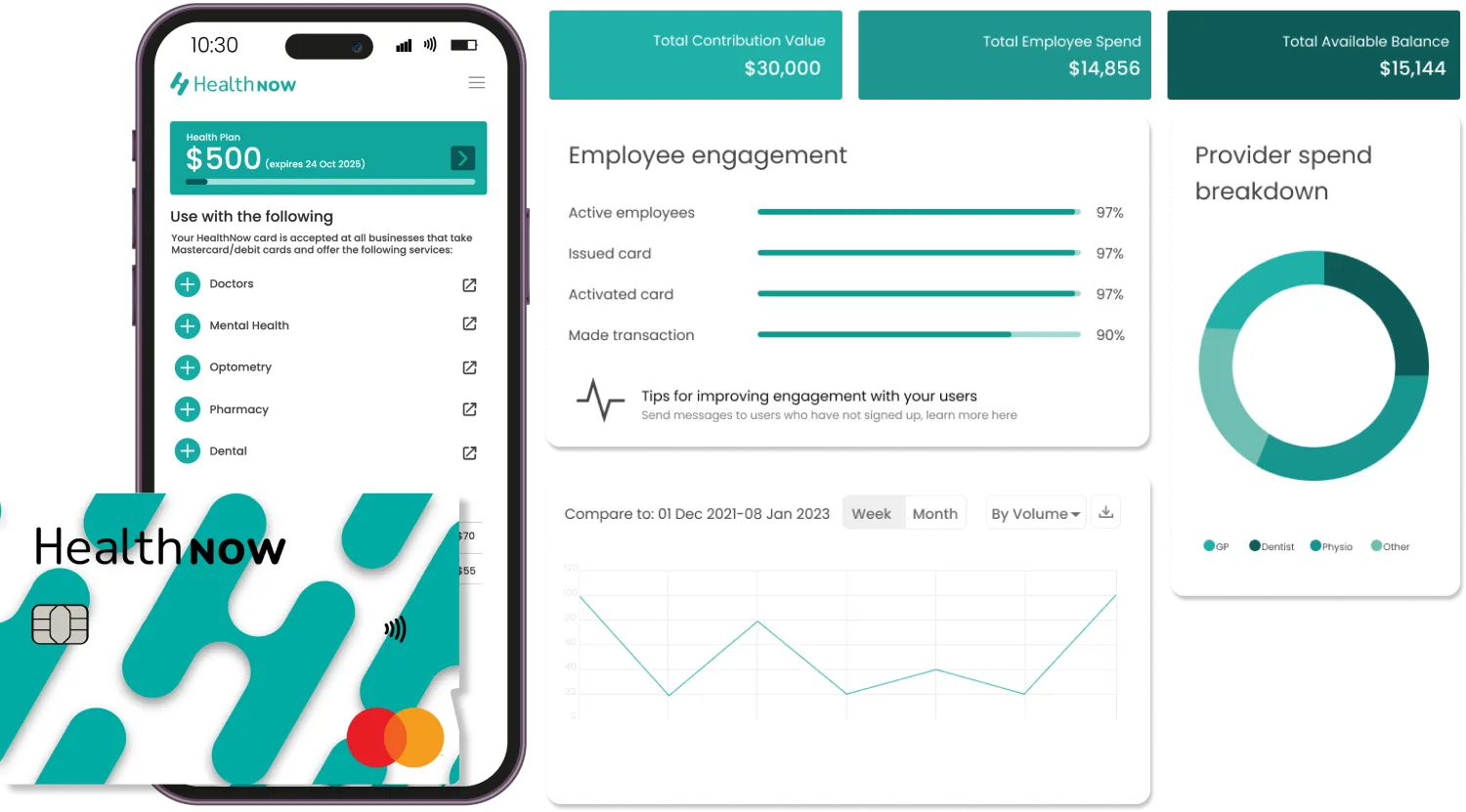

If you’re currently receiving contributions for private health insurance from your employer but aren’t seeing the value from it given your actual health needs and priorities, the first step is to alert your employer about offerings such as HealthNow’s employer aid, which has risen in popularity greatly over the last several years.

This model of self-insurance bears absolutely no costs to employers when making the switch from paying for traditional insurance, while easing the burden on employees by eliminating their monthly copayments. With full support from the HealthNow team, it is a very simple and attractive model for employers, with most employers being more than happy to discuss this option to decide what will be in the best long-term interest of their employees.

To learn more about HealthNow’s employer aid as an employee, see here.